Insurance companies do not always treat their policyholders fairly. Their primary goal is often to protect their own financial interests, which can result in delayed claims, reduced payouts, or outright denials. When this happens, policyholders are left struggling to recover from serious losses. The Dempsey Law Firm represents homeowners and business owners who have suffered storm or hurricane damage and need help pursuing the compensation they may be entitled to under their insurance policies.

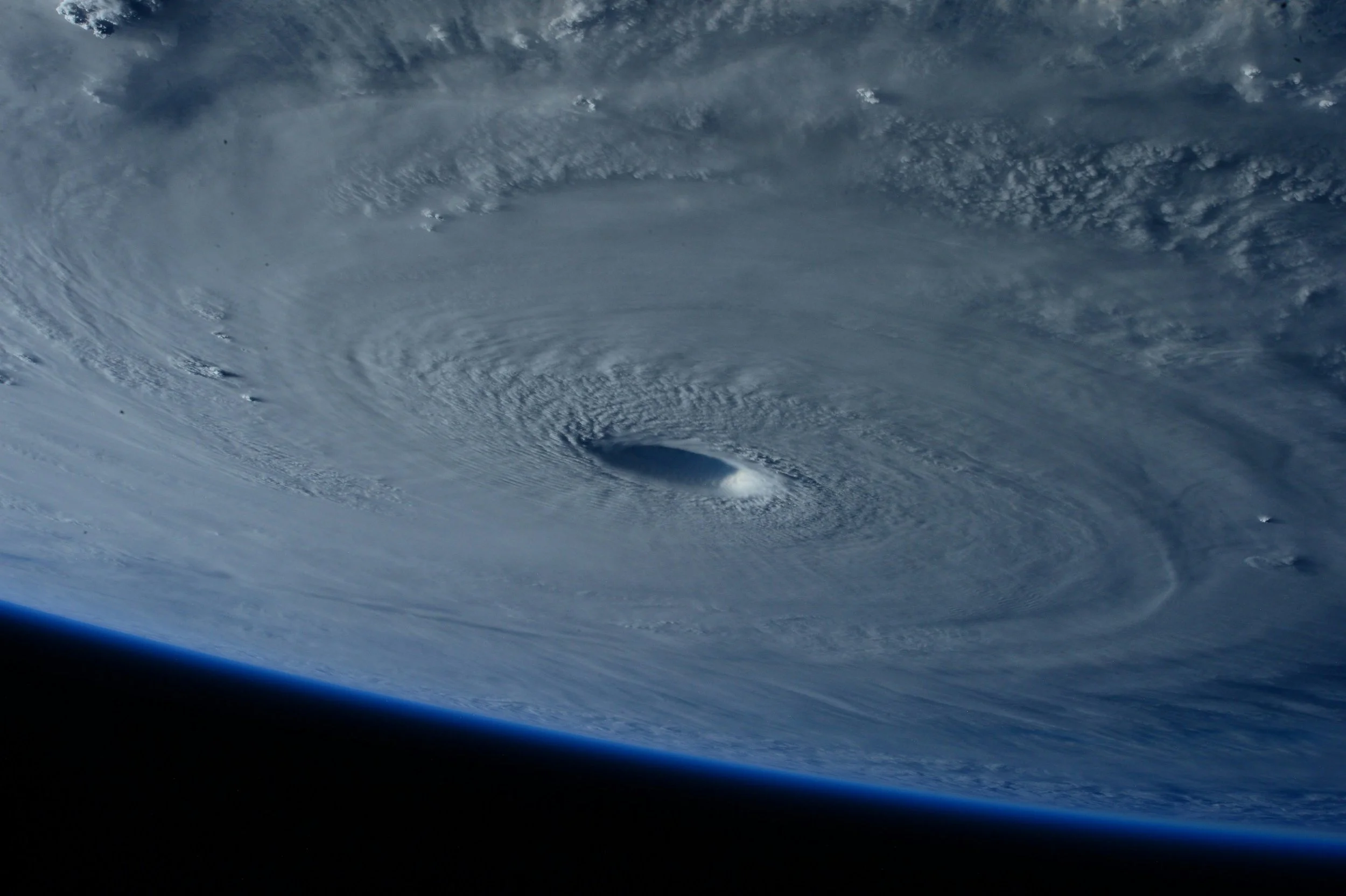

Hurricanes cause some of the most costly property damage in the United States, and Florida residents are no strangers to preparing for severe weather. However, once a storm passes, many policyholders discover that filing an insurance claim is far more complex and time-consuming than expected. Instead of receiving timely assistance, they often encounter delays, excuses, and settlement offers that fall far short of covering the true extent of their losses.

Most hurricane insurance policies are intended to cover a wide range of storm-related damage. This typically includes roof damage; water damage to floors, walls, and ceilings; damage to windows and doors caused by wind or rain; and harm to personal property such as jewelry, clothing, electronics, furniture, and appliances. Coverage may also extend to damage involving aluminum porches or sheds, fallen trees or branches, debris removal, and fires or explosions that result from a hurricane or severe weather event. Despite these protections, insurance adjusters may still attempt to minimize or deny valid claims.

Recovering from hurricane damage can be financially overwhelming, especially when losses stem from multiple sources such as wind, water, flooding, and debris. To protect your claim, it is important to act promptly and take reasonable steps to prevent further damage to your property. Carefully review your insurance policy to understand the claim-filing process and any deadlines that apply, as insurers may deny claims solely based on timing issues.

Before contacting your insurance company, it is often beneficial to speak with an experienced hurricane damage claims lawyer. Legal guidance can help you avoid common mistakes that delay or weaken claims and ensure your rights are protected throughout the process. If an insurance company engages in bad faith practices—such as failing to conduct a proper investigation, misrepresenting deadlines, withholding information, refusing to negotiate a legitimate claim, or failing to provide a written explanation for a denial—you may be entitled to additional compensation beyond the cost of property repairs.

Hurricanes cause some of the most costly property damage in the United States, and homeowners and business owners are accustomed to preparing for severe weather. However, after a storm occurs, many policyholders discover that the insurance claims process is far more complex and time-consuming than expected. Instead of prompt assistance, insurers may delay claims, offer inadequate settlements, or dispute coverage, leaving property owners struggling to recover from significant losses.

A typical hurricane or severe weather insurance policy is intended to cover a wide range of damages, including roof damage; water damage to floors, walls, and ceilings; damage to windows and doors caused by wind or rain; and losses to personal property such as clothing, electronics, furniture, appliances, and jewelry. Coverage may also extend to damage involving aluminum porches, sheds, trees, shrubbery, debris removal, and fires or explosions resulting from the storm. Despite these coverages, insurers may seek reasons to limit or deny payment, resulting in settlements that fail to reflect the full extent of the damage.

Protecting a hurricane damage claim requires immediate, careful action, as storm-related losses can come from wind, water, flooding, and falling debris. Identifying and documenting every loss is often complex, and insurers may deny claims based on missed deadlines or technicalities. Policyholders must take steps to prevent further damage, review their policies carefully, and strictly follow all claim-filing requirements.

Unfortunately, some insurance companies engage in bad faith practices, including failing to investigate claims properly, misrepresenting deadlines or policyholder rights, withholding critical information, refusing to negotiate fairly, or denying claims without explanation. When this occurs, policyholders may be entitled to recover not only the cost of repairs but additional compensation for the insurer’s misconduct.

Attorney Eliot Dempsey and the Dempsey Law Firm provide experienced guidance to protect your hurricane damage claim from start to finish. By working closely with clients, they ensure all losses are documented, deadlines are met, and insurers are held accountable. With their expertise, policyholders can avoid common pitfalls, maximize recovery, and gain the confidence that their claim is handled with skill and dedication.